Do we have a bank card for you…

Whether you’re a freshman student or a seasoned freelancer, Coin has the right card for you. Learn more about the perks of online-first banking and sign up for your card today.

Discover a whole new world of travel

Wether you are in or anywhere else in the world, free ATM withdrawals abroad and 24/7 customer service, Coin makes traveling the easiest it’s ever been. Upgrade your account and join the jet-set crowd.

School’s in. So is responsible banking.

Let your banking app make sure you never miss a phone bill and have your meal card topped up. Not to mention paying back that one true friend who spotted you those beers last Friday.

0% Interest? Interesting

Each Coin card comes with a credit line option at 0% interest for the first twelve months—so you only owe what you spend. Terms and conditions apply.

Everybody loves a discount

The rent is up and textbooks cost a fortune. What else is new? A lot! The Coin app brings you discounts at your favorite stores, cafes, and local businesses.

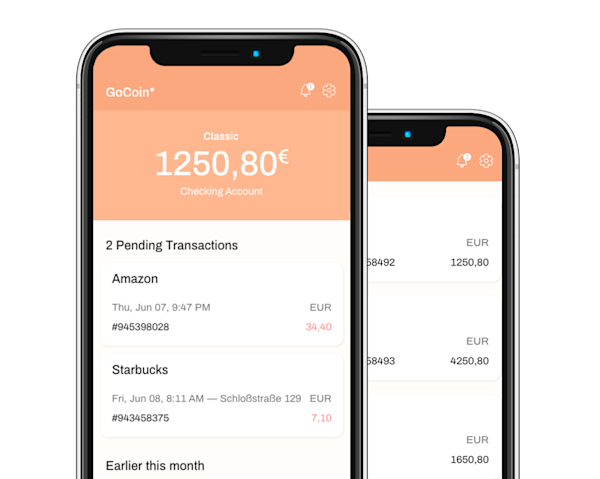

No queueing, no paperwork

Less forms, more action. As a student, you can sign up for a Coin card using your university email address and ID, no credit score paperwork required.

Free ATM withdrawals worldwide

The world of international banking is dark and full of small print. With Coin, you can withdraw cash for free from ATMs around the world. No surprises, no excuses.

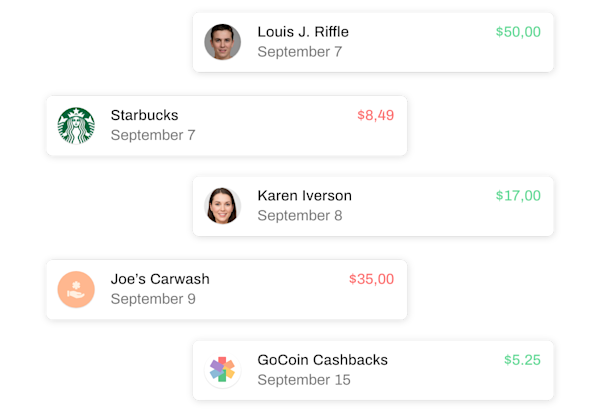

Say ‘hello’ to instant transfers

Banking transfers don’t have to take days. With Coin, you can instantly send and receive money from anyone with a Coin account. Simple, reliable, instant.

Comprehensive insurance: ON

Cover your phone, luggage, and health by swiping up on your phone. Coin customers enjoy comprehensive insurance packages from as little as €1.50 per day.

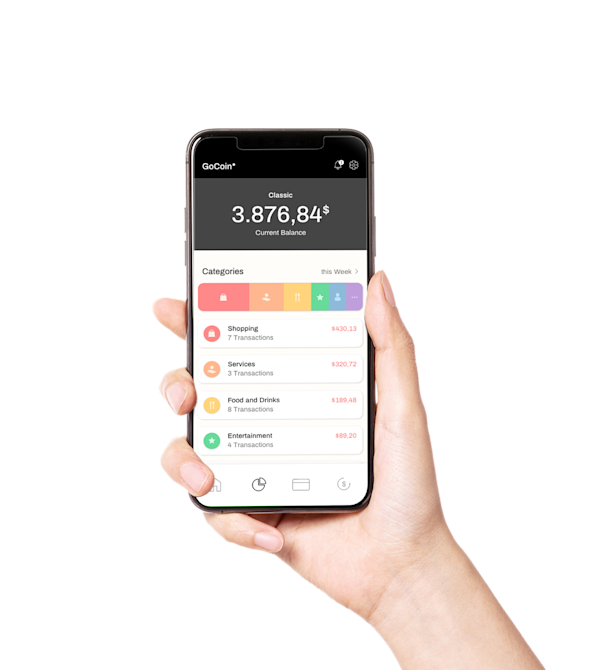

Stay in black with built-in budgeting

Budgeting holds the keys to financial independence. And it’s included in your app. Set daily and monthly spending limits, define saving goals and get insights on your spending patterns.

Stay safe with deposit insurance

All Coin users are covered by the European Union deposit insurance scheme up to €100,000 per account. Our bank follows strict capital requirements set by the European Central Bank. Your money is in reliable hands.

Saving gets an upgrade with vaults

Saving for a big purchase? Shooting for early retirement? Use vaults to help you achieve your financial goals. Choose from one-off and recurring transfers, do fixed contributions or save a percentage of your income.

New card, who dis?

Generate up to 3 virtual cards to pay for your online purchases. Virtual cards keep your physical card information confidential and minimize the impact of targeted hacking and third-party security breaches.

Earn cash back for every purchase

Get up to 3% of your cash back whenever you use the Coin card to pay for the purchases. There is no limit on rewards you can claim and no spending minimum to hit. Cash back rewards do not expire as long as your account is active. Certain restrictions may apply.*

Making a purchase? Touch and Go!

Smartphone is the new wallet. Use your phone to pay for the purchases, whenever you see a contactless payment sign. All it takes is a light tap with your phone. Coin supports both Apple Pay and Google Pay wallets.

Manage your money with the award-winning app

Pay your bills, transfer funds, redeem partner offers on the go. The Coin mobile app provides real-time balance overview, intuitive breakdown of your expenses, and advanced security features. The mobile app is available for the iOS and Android devices.

Pay less in interests and fees

Coin offers some of the lowest interest rates in the industry. Plus, our credit calculator helps you estimate in real-time the fees you will pay based on the credit amount and duration. Want to dig deeper? Calculate interests paid and fees due with the built-in budgeting tool.

Business or Pleasure?

From freshmen students to family businesses, Coin cards are designed to offer the right features and professional service with a human touch. Compare cards side by side and sign up today.

Coin Partner Program

Coin's growing customer base helps retail brands tap into a new source of customers without investing into new technologies or breaking into new markets. By providing advanced targeting tools, rich performance analytics, and multiple promotion formats, we let you grow your sales and generate customer insights.

Investment 101

Our exclusive collection of articles, videos, and study guides will help you understand key concepts and become familiar with popular investment strategies. Offering you many entry points to key topics, the course offers you a flexible way to learn as you go through life.

Feeling confident? You can leverage freshly acquired knowledge by building your very first investment portfolio. Our automated saving and investment tools help you focus on fundamentals and offer a smooth path to growing your financial equity.

© Copyright 2020